Benefits

Advantages

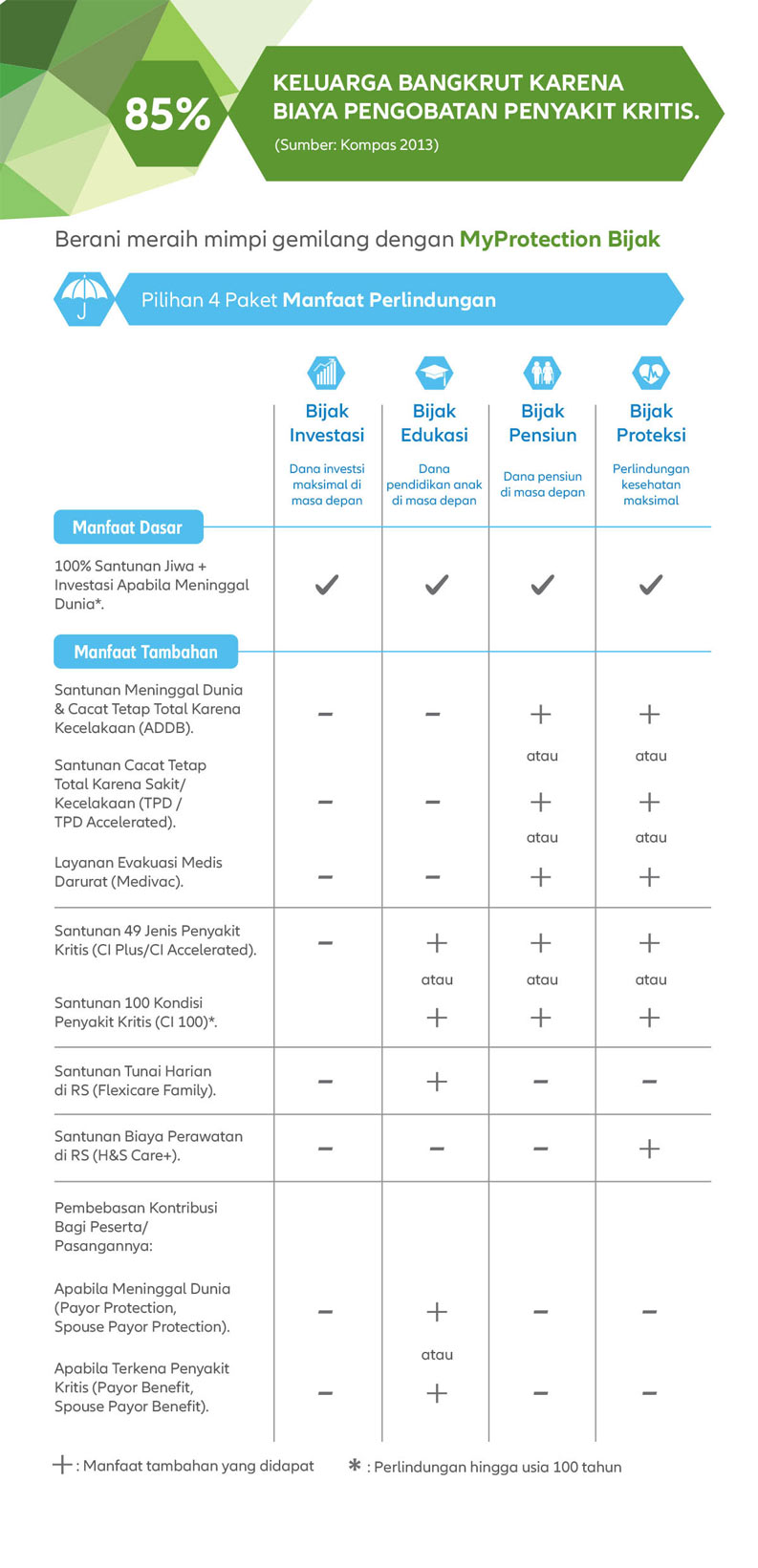

What are the benefits of MyProtection Bijak? *

Investment Benefits

Optimum Investment Allocation, whereby the Contribution placement is 105.26% ** since the first year.

** With the difference in selling price and purchase price = 5% (bid / offer)

Life Protection Benefits

If during the insurance period of the Insured Party passes away, Allianz will pay the benefit in the form of insurance compensation plus the entire balance of Investment Value in this Policy, calculated based on the Unit Purchase Price at the same time the claim is approved.

End of Policy Benefits

If the Insured lives until the end of the insurance period, Allianz will pay the final contract benefit in the form of all balance of Investment Value (if any) on the expiry date of the insurance period.

Policy Redemption Benefits

If the Policyholder dismisses the Policy or makes Policy Redemption, the investment value that is accumulated will be paid to the Policy holder.

Terms and Conditions

* Terms and conditions are fully arranged in the Policy.

Entry age

- 1 month to 70 years

Top Up

Periodic Top Up

- Monthly : IDR 250,000

- Quarterly : IDR 750,000

- Semester : IDR 1.5 Million

- Annual : IDR 3 Million

Single Top Up

- Minimum: IDR 1 million

- Maximum: There is no maximum for the total Top Up contribution

- Total Top Up contributions above IDR 2 Billion will apply Financial Underwriting

Contribution

- Monthly: IDR 2 Million

- Quarter: IDR 6 Million

- Semester: IDR 12 Million

- Annual: IDR 24 Million

-

Based on Underwriting decisions

Contribution Allocation

Basic Contributions: 105.26%

Top Up: 100%

Currency

Rupiah

Insurance compensation

- Minimum and maximum based on insurance compensation table

- Maximum insurance benefits for children (up to 17 years old): IDR 3 Billion

Underwriting Surplus

• 60% for Participants

• 20% for Tabarru

• 20% for Allianz

Underwriting Deficit: Allianz is loaned to pay insurance benefits in accordance with Al'Qardh principles and loans will be paid later by participants from the Underwriting Surplus.

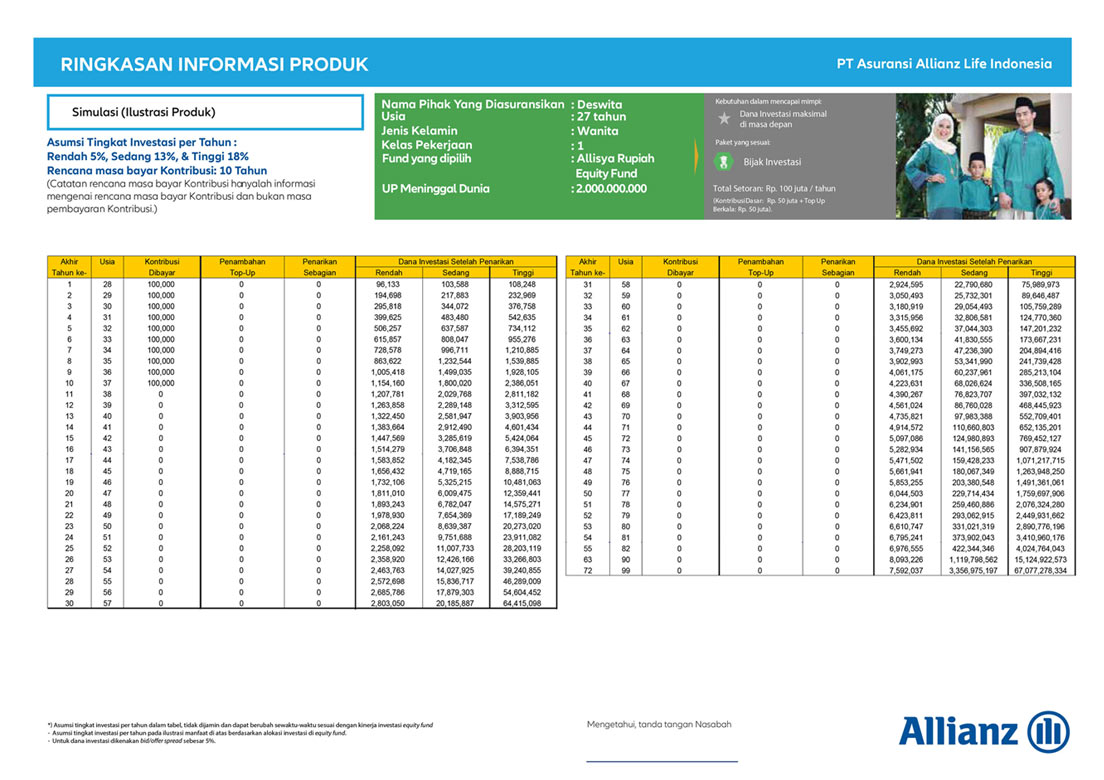

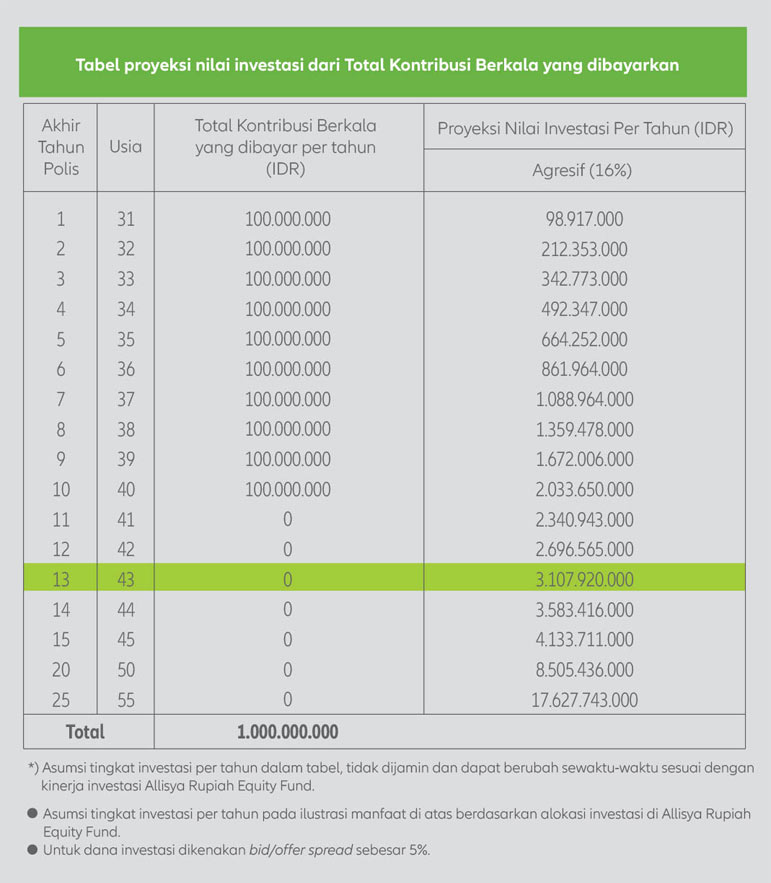

Ilustration

About Allianz

One of the largest insurance and asset management providers in the world founded in 1890 in Germany. Now Allianz is present in more than 70 countries, serving more than 75 Million Customers worldwide.

PT. Allianz Life Indonesia Insurance was established in 1996 and engaged in life insurance, health, pension funds and Shariah. Currently it has developed a distribution network of more than 44 cities through more than 87 business partner offices and more than 14,000 sales forces.

Important Notes

MyProtection Bijak is an insurance product issued by PT. Allianz Life Indonesia Insurance. PT Bank Maybank Indonesia Tbk ("Bank") only acts as the reference for MyProtection Bijak.

MyProtection Bijak is not a product of the Bank so the Bank is not responsible for any and all claims and risks arising from the management of this product portfolio. MyProtection Bijak is not guaranteed by the Bank and its affiliates and is not covered by the Government of Indonesia or the Lembaga Penjamin Simpanan ("LPS") / Deposit Assurance Institution. The Bank is not responsible for insurance policies issued by PT. Allianz Life Indonesia Insurance. The management and investment of MyProtection Bijak is carried out by PT Asuransi Allianz Life Indonesia and is the responsibility of PT. Allianz Life Indonesia Insurance. The performance of investment funds from PT. Allianz Life Indonesia Insurance can be seen on the monthly Fund Fact Sheet report.

PT Bank Maybank Indonesia Tbk is a bank registered and supervised by the Financial Services Authority.

Investments in capital market instruments containing market risks. Hence, the performance of this fund is not guaranteed, unit prices and revenue from these funds can increase or decrease. The performance of investment funds in the past is not an indication of future performance. Full information is in the Fund Fact Sheet.

The Contribution paid includes a commission for the bank.

A detailed description of the charges can be found in MyProtection Bijak Policy.

PT. Allianz Life Indonesia Insurance has been registered with and supervised by the Financial Services Authority, and its sales force has a license from the Indonesian Life Insurance Association.

*For further information, contact Maybank Customer Care at 1500611 or please visit the nearest Bank Maybank branch.