HELLO M2U

October - December 2024 Edition

What's New on M2U?

Convert digital gold into physical gold via M2U ID App

It’s easier to savings gold digitally. Not only gold buying or selling transactions. Now you can get physical gold/bars from Pegadaian gold savings through M2U ID App.

Physical gold can be picked up at Pegadaian branch office by bringing the e-ktp document.

- Variety of gold weight options are available.

- Easy to choose Pegadaian outlets.

- Check the latest physical gold request status.

Enjoy all the convenience pf savings gold right your couch! #M2UinAja

More DetailFeature Highlight

Update your personal data via M2U ID App

Please ensure your personal data registered in the Maybank system are up-to-date or current. Easy & convenient update your personal data anytime & anywhere through M2U ID App

Open Online Deposit via M2U ID App/Web

Start smart and safe investment steps with deposits. Choose the tenor according to your needs.It's more practical to open online deposits via M2U ID App/Web.

Get various benefits including: term deposits have more competitive interest and can be a passive income every month until maturity.

Mutual Fund Investment is more practical on M2U ID App/Web

Mutual fund investment provides optimal income in the form of investment value with diversified risk. Maybank provides 5 (five) types of Mutual Funds that can be adjusted to your risk profile and investment period.

Buy Mutual Funds online via M2U ID App/Web starting from only IDR 100 thousand with a one-time purchase option or automatically every month.

Manage Maybank Credit Cards on M2U ID App

Enjoy the convenience of managing credit card transactions in your hand via M2U ID App.

With various features such as: credit card activation, change PIN, change transactions to installments, copy card numbers and CVV, request limit increases and block lost cards.

Promo Highlight

Get various attractive prizes from transactions on the M2U ID App

Get the opportunity to take home a Samsung Galaxy S24, Smart TV, Play Station 5 and cash rewards or e-vouchers of up to IDR1 million with as many transactions on M2U ID App every day. Increase transactions on the M2U ID App, the more transactions, the greater the opportunity to get prizes.

Period 9 September – 30 November 2024.

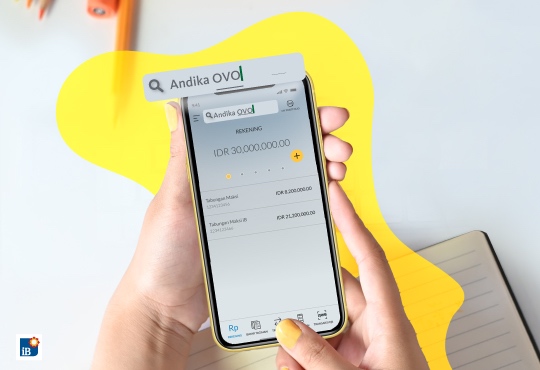

Get Rp30 thousand Cashback with QR Pay transactions on the M2U ID App

Shopping or traveling is easier with payment using QR Pay. Get Rp30 thousand cashback with a minimum of 4 transactions totaling Rp150 thousand. Valid for transactions at all merchants with the QRIS logo.

Period 24 July 2024 – 7 January 2025.

Invest Your First Mutual Fund on M2U ID App and get cashback!

Start by investing in Mutual Funds and get Rp50 thousand cashback with your first Mutual Fund purchase of at least Rp1 million via the M2U ID App.

Period 1 August – 31 December 2024.

Get extra gold balance by opening a gold savings account via the M2U ID App!

Enjoy all the convenience of saving gold just in your hand. Get an extra balance of Pegadaian Gold Savings up to IDR 400 thousand by opening a Pegadaian Gold Savings via the M2U ID App. And also get an additional balance of up to IDR 50 thousand by making the next digital gold purchase of min. IDR 1 million

Periode 1 August – 31 December 2024.

Tips & Trick

Fun Ways to Make Financial Resolutions in the New Year with the M2U ID App!

Financial resolutions are often one of the important things when heading into the new year. Even so, it is not uncommon for people to still find it difficult to make a realistic financial plan or to make it happen.

For those of you who want to have a healthier financial condition in the coming year. Here are some tips for making financial resolutions that can be realized, not just discourse:

- Monitor income and expenses with 360 Digital Wealth

It’s important to monitor income and expenses in order to have visibility into your cash flow. However, this habit is not easy to do if you do not have commitment and consistency.

With 360 digital wealth on the M2U ID App, you can also do regular financial checkups so that you can know your financial condition well. - Pay Bills On Time

One of the financial lists that you can do is to pay bills on time. Although it sounds trivial, paying bills on time can also provide many benefits. In addition to avoiding fines, paying bills on time can improve your BI checking credit score so that it will be easier when applying for a loan later.

Paying bills is easier anywhere and anytime via the M2U ID App/Web. You can pay telephone, electricity, water, internet and even credit card bills to loan installments. - Start Investing in Pegadaian Gold Savings

Investment is one solution to develop your current finances. Therefore, investment can be a financial resolution option for a number of people to increase income. One form of investment that can be done is by saving gold because of the potential for increasing profits every year.

Saving gold can now be done digitally. Saving digital gold can be done through the Pegadaian Gold Savings service on the M2U ID App. Saving gold can be done with a small nominal starting from IDR 15 thousand.

Article

How to Manage Family Finances in the Early Years to Achieve Financial Health?

By: Aliang Sumitro (Head of Wealth Management)

Starting the new year is the right moment to organize your family's finances so that they are healthier and more planned. With the right steps, you can ensure that your family's finances are in good condition throughout the year. Here are several important steps you can take to achieve family financial health:

- Evaluate Current Finances

The first step is to carry out a thorough evaluation of the family's current financial situation. Review monthly budget, income and expenses. Identify areas that may need improvement, such as unnecessary expenses or debts that need to be paid off. Creating a simple financial report that includes assets, debts and cash flow will provide a clear picture of the family's financial position. - Set Financial Goals

Setting specific and realistic financial goals for the year is very important. This goal could be saving for a vacation, children's education, paying off debt, or increasing an emergency fund. Make sure the goals set are achievable by measuring the extent to which you need to adjust your monthly spending and savings. - Create and Follow a Family Budget

Drawing up a detailed family budget will help control spending and ensure that every dollar is spent wisely. Allocate a budget for basic needs such as food, shelter, vehicle tax, education, a budget for annual events such as holidays and for other secondary needs and entertainment. It is also important to set aside some income for savings and investments. - Prioritize debt payments

If your family has debt, prioritize paying off high-interest debt first. Paying debt consistently and on schedule will help reduce interest costs and improve the family's financial health. Also consider creating a realistic debt repayment plan if you have several debts with different payment schedules. - Build an Emergency Fund

An emergency fund is savings that can be used to deal with unexpected emergencies such as job loss or urgent medical needs. Ideally, an emergency fund should cover 3 to 12 months of living expenses. Allocate a portion of your income each month to build or increase this emergency fund. You can invest emergency funds in instruments that have high liquidity and low risk, such as deposits and money market mutual funds. - Investment and Future Planning

Consider investing some of your family income to achieve long-term financial goals, such as your children's education or retirement. Choose investment instruments that suit your family's risk profile and financial goals. If there is a certain budget that will be used in the long term (above 5 years), then you can invest it in riskier instruments such as stock mutual funds. Also consult with your Personal Finance Advisor if necessary to ensure that your investments are well managed. - Review Insurance and Coverage

Make sure that your family has adequate insurance protection, including health, life and critical illness insurance. This insurance can help protect family finances from unexpected risks and reduce the financial impact of unwanted events. Sudden and unplanned large expenses are always the enemy in managing family finances. - Discuss finances openly

Open communication regarding finances is very important in the family. Discuss budgets, goals, and financial plans to make sure your partner understands and supports the plans. Good cooperation will make it easier to achieve joint financial goals. Make sure all financial plans that have been made are mutually agreed upon. - Follow-up and Adjustments

Periodically, review and evaluate the family's financial progress. Adjust budgets and plans as necessary to address changes in financial circumstances or family priorities. Regular monitoring and adjustments will help ensure that you stay on track to achieve the financial health you desire.

Together with the M2U ID App you can start the year with a solid financial strategy. Starting from paying bills to investing can be done in the palm of your hand. With the steps above, you can also improve your family's financial health and achieve the financial goals you have set.

Ask the Expert

What are the determining factors for an investment to be considered profitable and successful?

By: Aliang Sumitro (Head of Wealth Management)

Many people think that a successful investment is an investment that only provides profits, so people invest in instruments that can provide high returns in the shortest time. There are several factors that can help you make better and maximum investment decisions:

- Take risk into account.

In investing, the most important thing to manage first is the risk. Of course, there are many instruments that offer attractive returns, but this is not balanced by low risk. Instruments with high returns tend to have high risks too. Before investing, it is a good idea to study the potential risks that you may face. If you are able to control the risks, profits will come by themselves. Also get to know your risk profile so you can understand the level of risk you can bear before investing. - Investment Period

Adjust your investment period to suit your financial goals. For example, your child will go to college 6 years later, then you can still manage these funds in instruments with high risk such as shares or stock mutual funds. Meanwhile, if you plan to get married next year, it's a good idea to avoid high-risk instruments. You can place it in instruments that have low risk and provide guaranteed returns, such as deposits and money market mutual funds. Having a thorough budget plan will make it easier for you to determine your investment period. - Portfolio Diversification

You can divide your investment into several instruments according to your needs, according to the time period the budget will be used and according to your risk profile. You can also diversify into several other assets to reduce potential risk. Well-diversified portfolios tend to be more stable and can provide more consistent returns over the long term. - Historical Performance

Past performance certainly cannot be the basis for projecting the future. However, with existing historical data you can project relative annual performance and volatility when compared to the reference index. Studying history can also help you to recognize cycles that often repeat themselves in a particular asset. - Market and Economic Trends

Learning to recognize market trends and economic conditions can help you in choosing investment instruments too. Invest in investment instruments that are currently in an upward trend. Markets that are experiencing an upward trend do not always move up in a straight line. You need to understand that a market that moves in an uptrend also has healthy correction conditions. Conditions like this can be a good momentum for you to start investing. Also recognizing trends in the macro economy, such as interest rates, inflation and economic growth, as well as industry and market trends, can help you anticipate changes that might affect your investments. Successful investments often align with positive market trends or take advantage of favorable economic changes. - Management Quality and Expertise

For investments in investment manager or mutual fund products, the quality of management and expertise of the investment management team are important factors. Evaluation of an investment manager's track record and experience, as well as the approaches and strategies they use, can provide insight into the investment's potential success. You can start comparing the performance of mutual funds with their reference index. - Investment Liquidity

Liquidity refers to how easily an investment can be cashed out without significantly affecting the market price. Investments with high liquidity allow you to buy or sell assets quickly, while investments with low liquidity may take longer to sell or may incur additional fees.

By considering these factors, you can better assess whether a potential investment is profitable and successful. Always conduct thorough research and consider these factors in the context of your personal financial situation and investment goals to achieve optimal results. - Market and Economic Trends

Learning to recognize market trends and economic conditions can help you in choosing investment instruments too. Invest in investment instruments that are currently in an upward trend. Markets that are experiencing an upward trend do not always move up in a straight line. You need to understand that a market that moves in an uptrend also has healthy correction conditions.

Conditions like this can be a good momentum for you to start investing. Also recognizing trends in the macro economy, such as interest rates, inflation and economic growth, as well as industry and market trends, can help you anticipate changes that might affect your investments. Successful investments often align with positive market trends or take advantage of favorable economic changes. - Management Quality and Expertise

For investments in investment manager or mutual fund products, the quality of management and expertise of the investment management team are important factors. Evaluation of an investment manager's track record and experience, as well as the approaches and strategies they use, can provide insight into the investment's potential success. You can start comparing the performance of mutual funds with their reference index. - Investment Liquidity

Liquidity refers to how easily an investment can be cashed out without significantly affecting the market price. Investments with high liquidity allow you to buy or sell assets quickly, while investments with low liquidity may take longer to sell or may incur additional fees.

By considering these factors, you can better assess whether a potential investment is profitable and successful. Always conduct thorough research and consider these factors in the context of your personal

See Hello M2U in Bulletin Version

SHARIA

Halal Certification Registration

Halal Certification Registration

Shariah Wealth Management

Simpanan Syariah

Maybank iB Savings Account Promotions

Hajj and Umrah

Zakat, Infaq & Sadaqah

Sharia Business

Property Financing iB

Car Financing iB

Motorcycle Financing iB

Profit Sharing

Shariah Leaders Forum

OTHERS

Customer Support

Japan Desk

Promotion

Customer Support

News & Announcements

KPM Privilege

Locate Us

Refer a Friend

Fees & Charges

Rates Information

Maybank Basic Credit Interest Rate

Customer Education

External Link

Whistle Blowing

Security Privacy and Policy

Social Media Community Guidelines

Select Country